On 5th September, Melbourne hosted the annual Digital Banking Summit – bringing together over 150 banking executives to discuss the latest trends shaping the digital banking sector.

It was a busy day with an inspiring lineup of speakers from traditional banks and fintech start-ups sharing invaluable lessons and insights on the future of banking – from generative AI to data analytics, integration, automation and transforming customer experiences.

We break down the key takeaways from one of the year’s biggest events for the digital banking sector, proudly sponsored by Infosys | Simplus.

Embracing change in the digital era

The first topic of the day was on embracing change and overcoming key challenges in the digital era.

With technology and customer expectations evolving at a rapid pace, banks of all sizes are constantly having to adapt to change while facing potential disruptions.

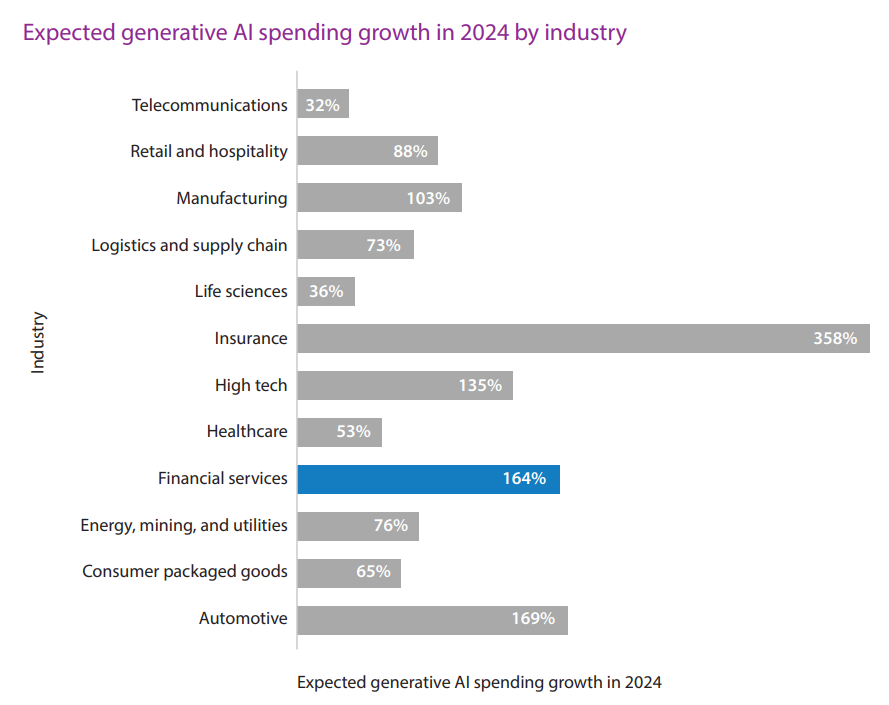

According to recent research, global generative AI spending in financial services is steaming ahead – projected to grow by 164% in 2024 to $2.6 billion. This ranks the financial services sector in the top three industries for GenAI spend after insurance and automotive.

Connecting the dots between data

Executives from Defence Bank, ANZ and Bank Australia shared their thoughts on trends, collaborations and disruptions driving the next evolution of banking in a panel discussion.

The panel consensus was that more than anything, data sits at the heart of successful GenAI deployment. A study from Infosys found that many banks are still struggling to overcome problems caused by their legacy technology, making it difficult to consolidate and maintain data on which AI models are built.

To deploy GenAI at scale, banks need to lean on partners to ensure they have the right skills and tools at their disposal. They must also focus on greater collaboration and integration through APIs, Open Banking and Embedded Banking, and establish robust policies and frameworks for data governance.

Harnessing the power of data, AI and automation

After a quick break, conversation quickly turned to data and AI, and how to harness it.

Banking technology leaders from NAB, CBA, Bendigo & Adelaide Bank and Judo Bank gave their take on the power of data analytics to inform strategic decision-making and operational efficiency. The panellists also discussed the future role of automation in handling traditional banking processes to improve efficiency and cost savings.

In Australia and New Zealand, research reveals that 79% of banks in the region have moved beyond the infancy stage of AI adoption, with 19% already at an advanced stage where the technology is fully embedded across their organisations.

AI hype to reality: Unlocking the real value

In the afternoon, Infosys | Simplus was thrilled to host the interactive workshop, ‘Data and AI in Banking: Unlocking Practical Value Beyond the Hype.’

We explored some of the common misconceptions about AI in banking, and how to separate the hype from reality. We also looked at the accuracy and reliability of AI systems, implementation costs, data privacy and trust and the role humans should play in monitoring AI systems.

Host David Strangward, ANZ Salesforce Practice CEO Simplus & Infosys, had this advice for workshop participants looking to incorporate AI adoption into their long-term planning.

“While banks wish to rapidly increase their GenAI deployment to take advantage of opportunities now, at the same they need to take a considered and strategic approach to how they scale the technology long term.

In the short term, organisations should prioritise efficiency use cases that boost productivity, followed by enhancing customer experience and risk management.

In the long term, a bank’s AI vision should be the amplification of major business and tech processes to speed decision-making, and hyper-personalising digital experience to make it truly unique for each customer.”

Enhancing CX and compliance in finance

Is the financial services industry betting on digital transformation to deliver personalised CX without compromising security and trust? Latest statistics suggest so, with 36% of those who have invested in digital transformation believing their investment will have a “calculated return.”

In our latest blog, we explore typical questions about Salesforce optimisation to enhance CX and compliance, such as:

- How can Salesforce AI and predictive analytics help to provide personalised investment advice?

- How can you provide a seamless digital banking experience across different devices using Salesforce?

- What tools does Salesforce provide to help manage compliance with data privacy regulations?

- How can financial services benefit from real-time financial dashboards?

- What does integration between Salesforce and blockchain technology look like to ensure secure and transparent transactions?

Have more questions? Talk to us about how we can help you use Salesforce technology to connect with your customers and deliver end-to-end digital experiences.