In early 2025, a shift began in banking: AI moved beyond pilots and proofs of concept. Institutions are now deploying it across business functions—from fraud detection to customer service—with tangible results, including reduced costs, streamlined compliance and more personalised experiences.

According to Infosys’ AI Business Value Radar 2025, 51% of AI use cases are delivering measurable impact, with nearly 20% achieving most or all of their objectives. Similarly, the Infosys Bank Tech Index confirms AI is generating the most value in fraud detection and customer service—the two most mature and widely adopted use cases—followed by business operations, portfolio management and software engineering.

Still, nearly half of AI initiatives remain stuck in pilot mode—held back by two persistent barriers. The two biggest obstacles? Regulatory complexity and poor data readiness.

Combined with siloed operating models, these constraints are preventing banks from turning tactical gains into strategic transformation.

This isn’t just a technology maturity issue—it’s about enterprise AI readiness.

What does enterprise AI readiness really look like in banking today?

Below, we explore the shifts, enablers and levers that turn stalled pilots into scalable enterprise impact.

AI Is No Longer Experimental—It’s Operational

AI is already delivering real results. Infosys research shows that over half of AI initiatives across industries now achieve measurable business outcomes—with 19% reaching full ROI.

But for many banks, AI remains a patchwork of pilot projects, disconnected from broader business strategies. The underlying challenge? Siloed AI efforts driven by narrow departmental needs and unsupported by scalable infrastructure.

This fragmentation not only limits value—it complicates risk management, undermines trust in models and fails to support enterprise-wide transformation.

Implication for IT leaders:

It’s time to elevate AI from a set of tactical tools to a strategic capability. This means embedding it into cross-functional workflows, aligning it to transformation KPIs and designing for scale from day one.

Data Readiness Is the Critical Bottleneck

AI is only as strong as the data that powers it. And here, most institutions are underprepared. Only 2% of organisations meet AI readiness benchmarks—most falling short on data readiness.

In banking, legacy systems, poor data lineage and decentralised ownership often result in inconsistent, inaccessible and untrustworthy data. Only 10% of organisations say their data is easily accessible and just 30% trust its accuracy and governance.

This creates real risk—model drift, bias and regulatory exposure—while limiting the ability to reuse models or scale across domains.

Strategic next step:

Approach modernising enterprise data infrastructure not as a technical upgrade, but as a business enabler. To unlock AI’s full potential, real-time data access, embedded governance and explainability are foundational elements—not aspirational goals.

Workforce Engagement Is the Accelerator

AI adoption isn’t just technical—it’s cultural. Infosys research reveals an 18-point lift in AI success when the workforce is engaged.

Yet many institutions limit AI to IT functions—missing the opportunity to build enterprise-wide ownership and fluency. Without structured change management, AI literacy programs, or clear transparency into how AI supports decisions, employee resistance is almost inevitable.

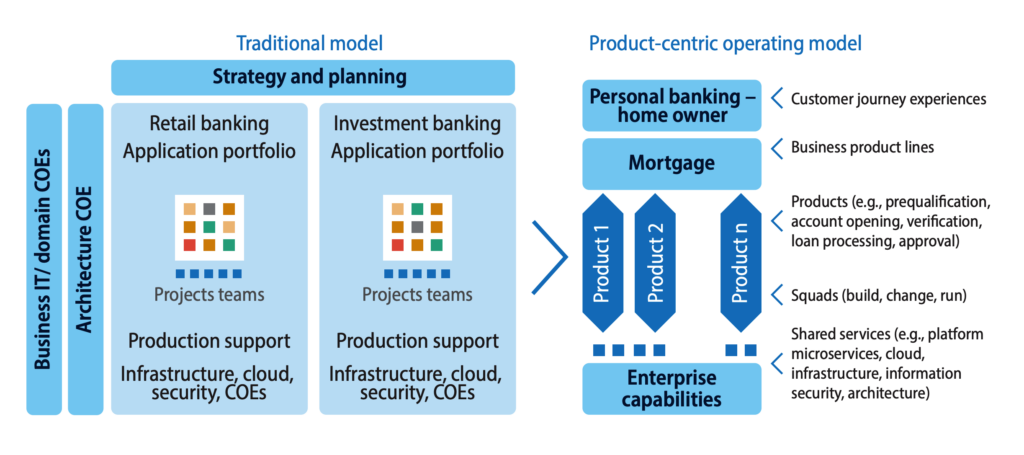

The alternative? Empower cross-functional squads who own AI delivery end-to-end. Organise teams around business outcomes, not just systems. Embed learning loops, decentralised decisions, and open collaboration across business, IT and data functions.

Achieving this shift requires a product-centric operating model—one that embeds cross-functional squads, iterative development and shared accountability (Figure 1).

Figure 1. A product-centric model democratises and atomises AI development in banking

Source: Infosys Knowledge Institute

Why it matters:

In regulated environments, trust in AI is non-negotiable. By involving the workforce in design and deployment, IT leaders can increase adoption, reduce risk and accelerate business impact.

Operationalise AI Governance

As financial institutions scale AI across critical business functions, governance becomes not just a safeguard but a strategic enabler. Yet today, 75% of financial services firms still lack formal AI governance structures, limiting their ability to ensure traceability, accountability and compliance as adoption grows.

In banking, where AI decisions affect customers, portfolios and risk controls, enterprise-wide oversight is essential. Regulations are tightening around accountability, transparency and lifecycle governance—requiring institutions to show how models are built, validated, deployed and monitored over time.

Creating a centralised Responsible AI office provides the clarity and coordination needed to manage AI effectively. Rather than reacting to risk, this function actively shapes how AI is developed, deployed and governed across the organisation.

Enterprise takeaway:

Governance is more than compliance—it builds trust, supports scalability and ensures AI aligns with regulations and priorities. For banking leaders, embedding governance is key to managing risk and unlocking lasting value.

From Point Solutions to Enterprise-Wide Transformation

To move from isolated AI experiments to enterprise-scale impact, financial institutions will benefit from an actionable roadmap. Each dimension—strategy, data, governance or talent—is essential to preparing the organisation for AI and scaling transformation effectively.

The Road to Salesforce-Enabled AI (Figure 2) offers a path to AI readiness—aligning strategic priorities, surfacing capability gaps and enabling institutions to deliver measurable value at pace.

Figure 2. The Road to Salesforce-Enabled AI

Source: Simplus, Fluido

AI readiness doesn’t require a linear approach. While data modernisation is often the most complex, organisations can make faster progress by first aligning strategy and upskilling talent. While data modernisation is often the most complex, faster progress is often achieved by first aligning strategy and building AI fluency across teams. In many cases, it’s the weakest link—whether data access, governance, or adoption—that holds back broader progress. Identifying and strengthening these bottlenecks is one of the most effective ways to accelerate readiness and unlock enterprise-wide benefits.

Closing Thought: AI Readiness Is an Enterprise Imperative

For banking leaders navigating economic uncertainty, regulatory pressure and evolving customer expectations, AI readiness is no longer a technical conversation—it’s a strategic priority.

Those who move early to mature their AI capabilities will gain a competitive edge—unlocking new levels of agility, intelligence and enterprise-wide value.

Accelerate your path to Enterprise AI

Our AI Innovation Workshop helps financial institutions identify high-impact use cases, prioritise investments and build readiness across strategy, data, governance and workforce.